|

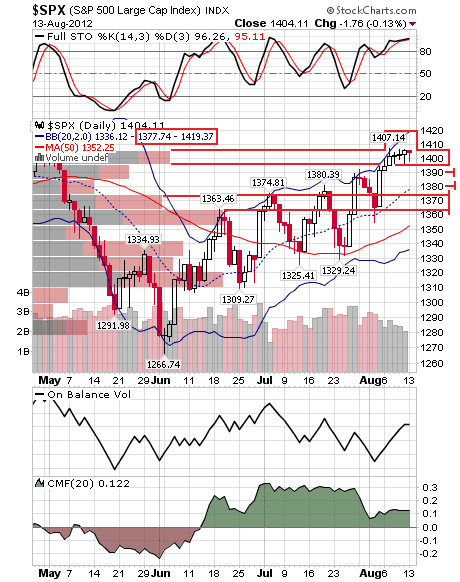

| SPX Daily |

Monday, August 13, 2012

Primed for a shakeout

Intraday update

|

| S&P Futures 30min |

Intraday volume is pretty light so far and is suggesting we might have already seen the majority of the days range. It's indicating potential of a 7-10 point range.... and with the high of the day session at 1402ish, that puts a low target area of 1392-1395. LOD so far is 1394.25.

A Stock With Two Gaps: RAX

|

| Gator's Chart of the Day: RAX |

Some folks say gaps always fill ... I'm not one of them but in this case I'll go out on a limb and say one of these gaps will.After reporting good earnings last week RAX gapped up and pulled back to a previous resistance level. (Prior resistance has become current support.) It can now go either up or down and fill a gap. I like the upside move and I think there is a short term trade here.

The Trade

The stock can be bought between 52.66 and 54 with a stop just below 52.50. If it falls back into the gap then I don't want hold it while it probes to find the next level of support. The minimum upside target is 57.80 which would fill the early May gap. Keep an eye on volume and only add if price is moving up with increasing volume. When the stock stops going up and volume falls off move your stop up tight and let the market take you out of the trade.